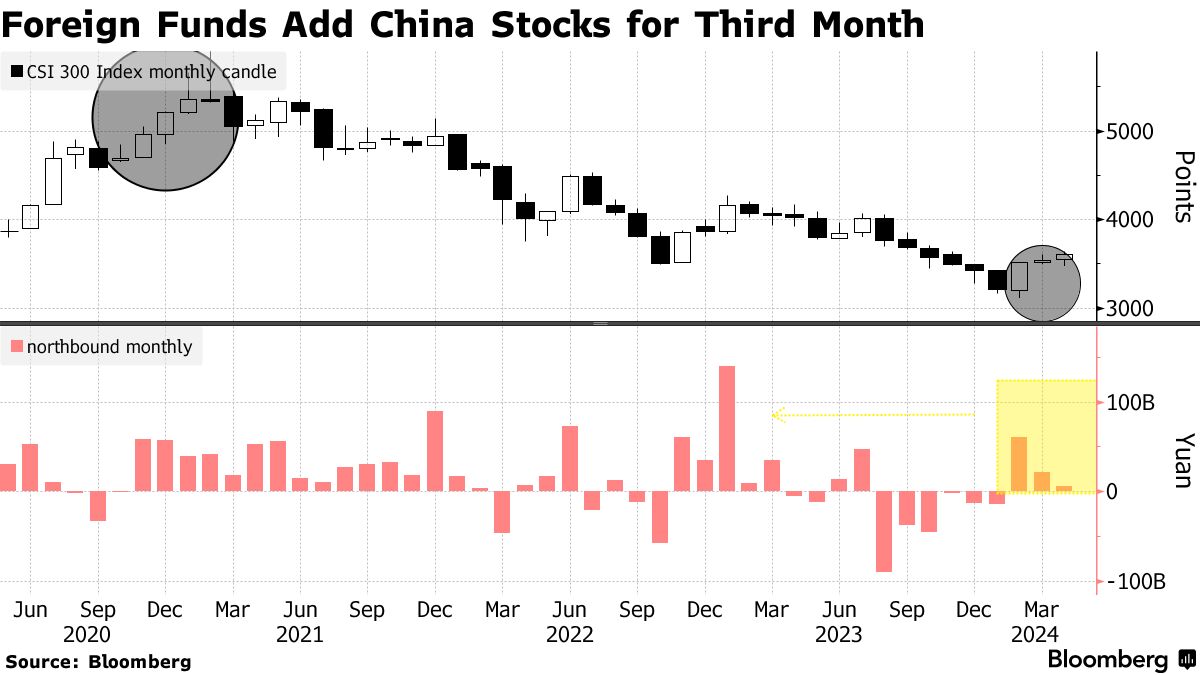

We've speculated that Chinese companies were tipped by the government/party to transform currency into commodities as the yuan weakened from 6.80 to buy a dollar to 7.24.

However, after last night's action we may have to put that theory on the back burner for a bit.

Here's six months of yuan vs dollar, down is stronger yuan:

TradingView

And from Reuters via the Bangkok Post April 29:

In the eastern Chinese port of Dongying, the start of

2024 has often seen several tankers docked simultaneously discharging

Russian crude oil into a new 31.5-million-barrel storage facility

completed late last year.

It is, traders say, all part of a

concerted and deliberate Chinese effort to build up strategic stockpiles

for a perhaps uncertain future.

Estimates of China's total strategic energy reserve vary from 280 to

400 million barrels, the upper amount exceeding the US Strategic

Petroleum Reserve at roughly 364 million. China consumes some 14 million

barrels a day of oil in peacetime.

What does seem clear, however, is that China is deliberately

stockpiling at speed, part of a much wider national effort to accumulate

essential raw materials and resource.

When it comes to energy, much of the new inflows now come primarily

from Russia, whose energy exports to China rose by roughly one quarter

last year to a record 2.14 million barrels per day.

That makes the Kremlin Beijing's largest energy supplier for the

second year running, overtaking Saudi Arabia -- and allowing China to

benefit from substantially discounted Russian oil as US and Western

sanctions have turned away multiple other buyers since Vladimir Putin's

2022 invasion of Ukraine.

Beijing's stockpiling of oil is just one example of what appears a

broad national effort to significantly increase the holdings of key raw

materials. It is a move that some increasingly suspect is intended to

help insulate Beijing against any future war or international sanctions,

such as those that might be sparked by a potential Chinese invasion of

Taiwan.

In a piece for international affairs and conflict blogging site "War

on the Rocks" published on April 17, Mike Studeman, former commander of

the US Office of Naval Intelligence and intelligence and director of the

US Indo-Pacific Command, argued that this was part of a much wider

process.

"Xi Jinping is preparing his country for a showdown," he wrote,

describing the Chinese leader as "militarising Chinese society and

steeling his country for a potential high-intensity war."

Part of that, he suggested, included building up strategic stockpiles

of essential goods and resources, protecting China against the kind of

sanctions imposed on Russia after its Ukraine invasion -- or, indeed, a

militarily enforced blockade as part of a regional or global war.

Other examples of heightened preparedness, he said, included the much

higher tempo of Chinese military operations around Taiwan -- designed

to both exercise China's military and implicitly threaten the government

in Taipei with the consequences of its own total military blockade.

US officials say they believe Mr Xi has given his armed forces until

2027 to be prepared to invade Taiwan, although those inside and outside

the US government remain divided on whether a decision to actually

attack has genuinely been made.

This week, the outgoing head of the US Indo-Pacific Command said

Beijing was continuing to plough resources into its military despite

economic turmoil caused by a real estate crisis and a slump in US-China

trade.....

...China's government buyers have never been ones to turn down a

bargain, frequently building up their national stockpiles when

short-term prices fall. Newly imposed Western sanctions on Russian

nickel, aluminium and copper that entered force this month are seen as

likely to spur further Chinese buying.

When it comes to lithium, a vital component in many types of battery,

Beijing has bought up not just stock but also processing facilities and

mines, including overseas.

In March, investment bank UBS estimated that China might control a

third of all global lithium supply as soon as 2025, again exploiting a

price crash to further build its holdings....

....MUCH MORE

We still think the PBOC and the government will resume the slow motion devaluation but there is always the consideration of the couple trillion in dollar-denominated debt that gets tougher and tougher to service, much less pay off, as the yuan gets weaker.