Just beware of analogues that prey on the fact humans are animals with pattern-recognizing brains.

From Ciovacco Capital's Short Takes:

Everything Old Is New Again

In a 1991 episode of Seinfeld, as Kramer pleaded with Jerry to install illegal cable he uttered:...MORE

Man, it’s the 90s. It’s Hammer Time!Some analysts on Wall Street are drawing similarities to the 1990s, a period marked by extraordinary returns in the stock market and M.C. Hammer’s moment in the sun. From Bloomberg Business Week:

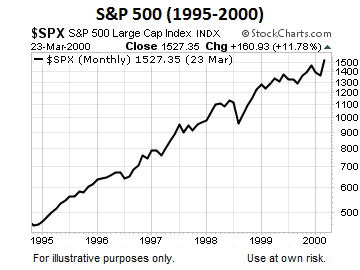

Early in 1992, Time magazine projected that the nascent economic recovery would be “one of the slowest in history and the next decade one of lowered expectations.” That was the conventional wisdom and, at the time, seemed eminently reasonable. It also turned out to be completely wrong. The Internet and huge productivity gains propelled above-average economic growth and a rip-roaring, “Cult of Equity” bull market that surged into the year 2000.In a recent research note, Schwab’s Liz Ann Sonders pointed out numerous similarities between today’s market environment and the mid-1990s, including:

The Glass Is Half Full

- Post-financial crisis period (S&L crisis then, housing crisis now)

- Slow, “jobless” economic recovery

- Similar stage within economic cycle

- Extremely easy monetary policy, but “normalization” beginning

- Low inflation

- Today’s eurozone = 1990s Japan

- Government shutdowns (1995-1996 and 2013)

- Midterm election year (1994 and 2014)

- Rapidly improving federal budget deficit

- Minimum wage hike

- Technology revolution

- Rising valuations from depressed levels

- US market outperforming emerging markets

- Record-high margin debt levels

- Rising volatility

- Increasing equity mutual fund inflows

In recent weeks, we have outlined our present day concerns about an indecisive and increasingly vulnerable stock market. In today’s analysis, we will assume the 1990 similarities are relevant.