Why Bubbles Are Being Recognized

The nature of liquidity under the eurodollar standard is to essentially link “markets” that outwardly seem to have little or no relation. You can see the synchronized ups and downs quite clearly but miss the ultimate connection, especially under the orthodox assumption of the world’s economies and their “natural” finance as mostly closed systems with only tenuous associations.

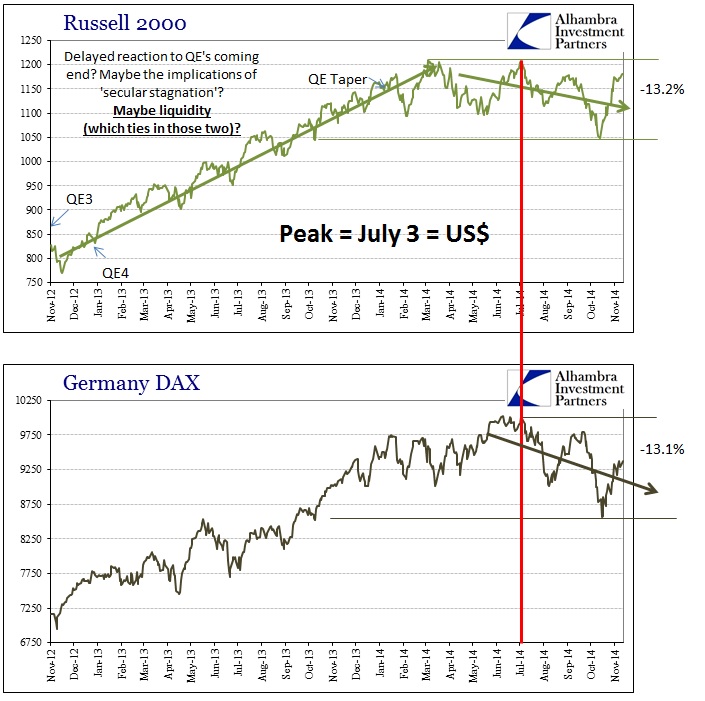

If that were really the case, then the very clearly correlated movements in 2014 between the Russell 2000 and Germany’s DAX, of all places, would make no sense whatsoever. That would be even more puzzling under the conventional narrative being driven by economists where the US is sailing in the “right” direction while Germany is not.

The interconnected nature of the global dollar short being evident, there remains at least one participant short of a fully encompassing regime. Thus liquidity seems to operate under separate rules and standards for at least big cap stocks in the US in contrast to the more leveraged small caps (and thus more susceptible to swings in liquidity).

However, that isn’t a fully accurate description, as the leverage and liquidity elements of, say, the Russell 2000 and the DAX relate to what are truly financial elements. The S&P 500 is itself undoubtedly buoyed by massive leverage, though it simply comes in a different format almost unattached to the same financial factors. That is why the dollar interruptions in 2013 and again in 2014 show no imprint on the S&P 500 or DJIA.

The most obvious effect of QE’s so far has been on corporate balance sheets. Despite all the chatter about record cash balances, and there is that, all that cash relates to prudent (relatively, of course) liquidity management as company debt levels have exploded (though a huge amount suddenly disappeared in the last update to the Flow of Funds accounts). As anyone paying attention well knows, corporations at the larger end of the scale have been using that debt (and a good proportion of internal resources too) to repurchase shares....MUCH MORE

Corporate balance sheets, again especially the larger firms, are the QE pivot whereby “cheap” debt is turned directly into share prices. That is why (and not the only reason, but I surmise it to be the primary) the S&P 500 can move along on its merry way without regard to financial liquidity and “dollar turmoil.” There is no need for a more complicated or convoluted explanation, especially as this is exactly as then-Chairman Bernanke intended (he just expected that such a “wealth effect” would actually impact the real economy in a more positive manner rather than just the negative thrust of price instability)....