From Platts The Barrel blog:

Guest blogger Jonathan Kingsman is the founder of Kingsman SA, which is now a unit of Platts, and he remains a Platts consultant.

Are low oil prices good or bad for oil traders?

In theory oil traders should not care about the price of oil; as they have reminded us many times recently, the big trading companies trade differentials and spreads, not flat (outright) price.

In a trader’s ideal world oil prices would fluctuate in a range, giving traders just enough volatility for risk-free plays on shipment dates and tonnages.

On the plus side, low prices have reduced financing costs and capital requirements. The halving of the oil price since June 2014 means that for the same amount of money, trading companies can hold twice as much stock, something that comes in rather handy with the current contango in the oil market.

So rather than being bullish or bearish on the flat price for 2015, oil traders may be wishing for a “buffalo” market where prices are at home in a range: a stable (but weak) flat price accompanied by a strong contango.

The world is beginning the New Year with an estimated oil surplus of one million barrels/day. This surplus could be cut if the situation in Libya worsens but neither OPEC nor Russia is likely to cut: they are more concerned about market share than price.

As for the US shale oil producers, the oil price drop should result in a sharp reduction in capital expenditure. However, a recent report by Citibank argued “a capex cut of up to 60% would still see growth (in production) in 2015 due to inertia, but could keep production volumes constant in 2016 (but with growth from 2017 onward)”....MORE

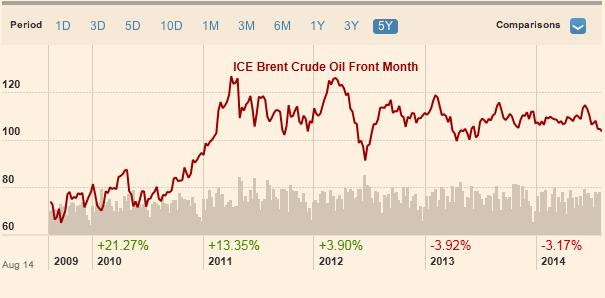

Here's a range-bound market that FT Alphaville brought to our attention last August:

In early December the market became aware the Chinese were ordering every tanker they could get their hands on to build their strategic petroleum reserve.

The second weekly upmove was the result of the dawning realization of the contango trade. Buy physical at spot, store, hedge in the futures market, deliver (or sell elsewhere).