And as usual, apologies to Eijk Van Otterloo, the headline flows better if I relegate the name partner to Beane status.

(a nod to erudite MER alums)

From FT Alphaville:

The absence of skill

A tongue twister:

Peter Piper picked a peck of stock pickers;

The pick of picking pickers Peter Piper picked;

If Peter Piper picked the pick of stock pickers,

Who’s the pick of picking pickers Peter Piper picked.

The subject is the skill of active investment managers prompted by a GMO white paper which reports 80 per cent to 90 per cent of US equity funds failed to beat their benchmark last year. Do you try to pick stocks, or do you pick stock pickers, or do you pick the picker of stock pickers?

Or to put it another way, if you are a trustee charged with safeguarding money, say public retirement funds, which problem do you choose to face? You can try to beat the market by picking stocks yourself, which is time consuming and bad for restful sleep. You can try to beat the market by choosing someone to manage the stock portfolio for you, but you know evidence shows the average manager is not worth his fees over the long run, and why should you be better at picking people than stocks.

The final option is to remove yourself one step further, by choosing an investment consultant to pick the people who will pick the stocks. There are far fewer consultants than money managers, and you are unlikely to look bad or have your fiduciary duty questioned by choosing one.

Of course, the superior option is not to play the picking game at all. Take comfort in a diversified selection of passive investments such as index funds, and stop leaking money to advisors in fees.

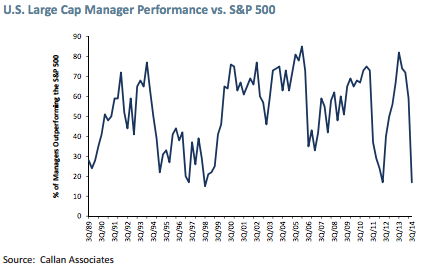

GMO, however, attempts a defence of active management. Neil Constable and Matt Kadnar have a look at large capitalisation US stock funds and find something odd, underperformance and outperformance versus the market happens in waves. Rather than half of managers doing better and half worse than the market (before fees are deducted), the data shows herding: “it is far more typical for either two-thirds of managers to outperform, or for two-thirds of managers to underperform. Almost everyone wins, or almost everyone loses.”

It turns out the collective decisions have very little to do with stock picking or sector and style biases — value versus growth, for instance. GMO argues it has to do with “out of benchmark allocations”, holdings of non-US stocks, small companies or cash, for instance. If a fund manager has several per cent of their portfolio in these assets, which is not uncommon, in any year the fund will either have a head start or a handicap to the market....MORE

http://dilbert.com/strip/2014-10-27

Possibly also of interest:Gaming the System: Are Hedge Fund Managers Talented, or Just Good at Fooling Investors?

More on The Top Earning Hedge Fund Managers and The Metaphysics of Moolah

The Market Pays Luck as Well as Skill

Taleb Makes Hyperinflation Bet and Why You Might Want to Be Skeptical

Eugene Fama: Do Active Managers Earn Their Fees?

Fama/French: "Luck versus Skill in Mutual Fund Performance" (LMVTX)

What Were the Odds That Legg Mason's Bill Miller Would Achieve the Results That He Did?

Financial Salesmen and the Illusion of Certainty