Did the Fed’s QE actually do anything for the real economy?

Eric Rosengren, the President of the Federal Reserve Bank of Boston, gave a speech in Frankfurt on Thursday arguing that the Fed’s full employment mandate gave the central bank more flexibility to be aggressive earlier, and that open-ended programmes that are tied to economic targets are more effective than purchases of predetermined size and duration.

Nothing novel there. But his speech also contained, perhaps inadvertently, some interesting arguments that the rounds of bond-buying after the acute phase of the financial crisis did little for the real economy. (We covered the tenuous relationship between asset purchase programmes and inflation here.)

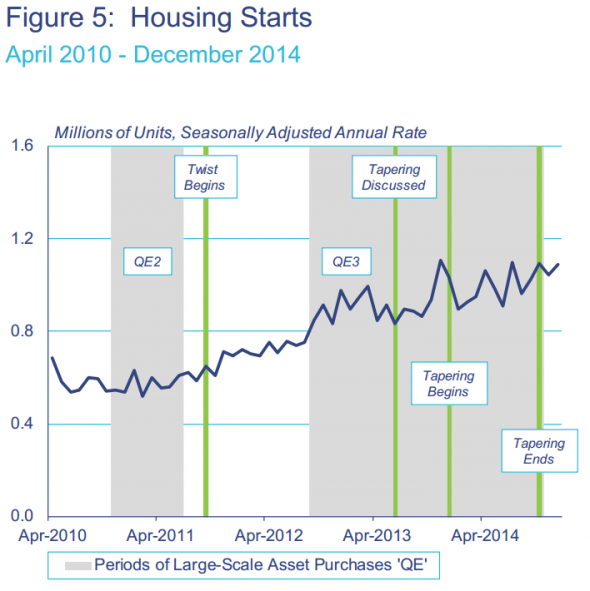

To see it clearly, we reproduced a few of his charts, which helpfully delineate when the central bank was actively attempting to step harder on the gas pedal and when it wasn’t. His commentary is interspersed between them:

...MUCH MOREFigure 5 shows that there was no notable change in housing starts during the period of QE2. However, housing starts did improve over the period of Operation Twist and QE3. After averaging 569,000 units during QE2, starts averaged 708,000 units from early on in Operation Twist through August 2012. During the past 6 months, starts have improved to averaging over 1 million units.