As I mentioned in 2009's "In Downturn, Americans Flock to the Movies (But Don't Bet on It)":

...A quick look at the Cowles Theaters and Motion Pictures sub-index* (price series P-55, page 152) shows the index bottoming at 46.0 in October of the 1921 bear market, a Roaring 20's high of 150.6 in January 1929 and a depression low of 5.1 in March, 1933.That bit about the investment banks is an often overlooked feature of the 1970 NYSE rule change that allowed members to be joint stock companies rather than individuals or partnerships.

Although the business held up fairly well in the first year of the depression, they ended up a bit worse than the general market. Between th '29 high and the '33 low they lost 96% vs. the DJIA's 89% fall....

...There are two problems with the business as an investment.

First, similar to the investment banks, when times are good the profits belong to the employees. When times are bad the losses belong to the shareholders....

Starting with Donaldson, Lufkin & Jenrette's 1970 IPO and the flotations of Merrill, Reynolds & Bache in '71 the floodgates were open and the business was changed forever.

The culmination was the Goldman Sachs IPO, May 3, 1999 during the market madness that top-ticked early the next year. (Prospectus)

So yeah, the fact that Klein has internalized the business model gives me warm fuzzies.

From FT Alphaville:

Beneficiary of rent extraction says rents explain inequality

Peter Orszag has a new column arguing that insufficient attention is being paid to “profits at some companies well in excess of what’s necessary to keep them in the market” as a source of inequality. This is far from being an original idea, although we appreciate Orszag’s citation of data on factory-level productivity.

However, we were struck by an odd omission. While Orszag is quick to note the importance of patents and land values, he leaves out any mention of the large subsidies enjoyed by the financial sector. (Orszag is paid several million dollars a year as a vice chairman at Citi.) That obscures a lot.

The International Monetary Fund has estimated that the big US banks received possibly more than all of their profits from the implicit subsidies associated with being “too important to fail”, as opposed to actually producing anything of value.

That supports Andy Haldane’s hypothesis that the supposed post-1980 productivity miracle in finance, which was calculated by blindly trusting the big banks’ reported profits, was simply the result of greater risk-taking — and therefore larger hidden transfers from the rest of society — rather than any genuine value creation.

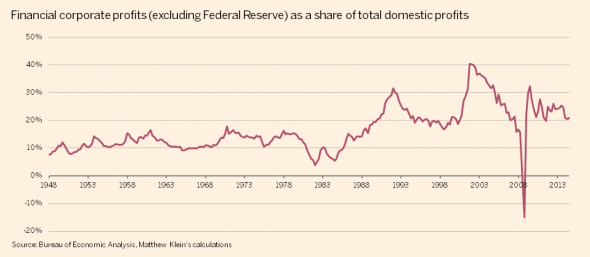

For perspective, the financial sector contributes about a fifth of total US corporate profits. That share has grown tremendously since the late 1970s, and is a big reason why overall US corporate margins are so much higher now.

But profits are only one piece of the puzzle. Unlike, say, Apple, which depends on ill-treated Chinese labourers for its fat margins, workers in the financial sector are paid very well. It bears repeating that investment banks are Marxist paradises where an overwhelming share of the surplus is captured by the people who produce it, rather than outside shareholders. This also has had a big impact on the inequality statistics....MOREThat Marxist link goes to a piece Mssr. Klein penned while working at Bloomberg:

Proletarian Bankers Feeling the Capitalist Yoke

This is almost enough to make one want to go visit Marx, Sraffa, Ricardo and the boys.

Banks have long been oddities -- fiercely capitalist in their treatment of others, yet run like Marxist bastions where labor, rather than capital, captured much of the value created. (Just look at the share of revenues that went to employee compensation before the crisis, or the bizarre fact that, in essence, banks only adjust their balance sheets by borrowing more or less rather than issuing or retiring equity.)

This seems to be changing, thanks in part to tighter leverage limits. According to Bloomberg News, the workers' paradises are finally under assault from newly class-conscious capitalists. The rest of us should be pleased.

Leverage rules are meant to shield taxpayers from bearing the costs of bank failures and, by extension, take away the subsidies that enrich bankers and bank shareholders during the good years. Society as a whole benefits because crises become less likely and less costly, but those forced off their taxpayer-funded gravy train are stuck figuring out how to split the cost between workers and owners. So far, capital has borne the brunt of the new regulations with lower returns on equity....MORE

More to come.