From The Capital Spectator:

Retail spending in the US rose 0.5% in May, the Census Bureau reports–a bit better than economists expected. The gain marks a sharp downshift from April’s 1.3% bounce. But April’s unusually strong advance isn’t sustainable and so it’s no great tragedy that today’s report is weaker by comparison. Overall, looking at the last two monthly increases suggests that there’s still a healthy glow for retail sales. A less-encouraging profile emerges, however, when we focus on the year-over-year trend, which is probably more reliable for analyzing the appetite for spending.

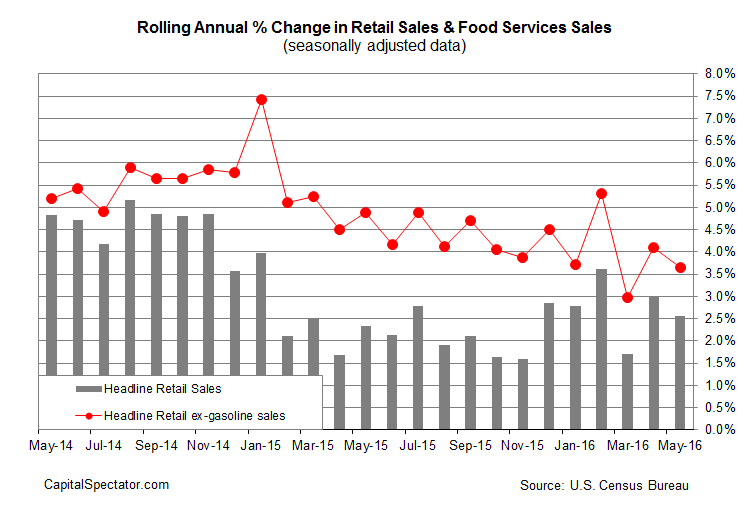

Consumption is still climbing a decent if unspectacular pace in annual terms through May. But recent history suggests that gravity’s slight but persistent hand is at work. Headline retail spending rose 2.5% for the year through last month, down from 3.0% through April. Stripping out gasoline sales paints a firmer trend, but the deceleration in year-over-year spending growth is becoming conspicuous this year. Indeed, retail ex-gas consumption climbed 3.7% in May vs. the year-earlier level, which is at the low end of the annual range in recent years.

There’s certainly no smoking gun in today’s report. It’s reasonable to argue that the consumer is still inclined to spend at a rate that’s consistent with economic expansion. But we’re near the lower range of growth that passes the smell test for concluding that a growth bias is still a credible alive and well.

The question is whether the slow slide will endure? If it does, there could be trouble lurking in this year’s second half. Unfortunately, today’s numbers don’t make a strong case for arguing that the downside momentum has run its course....MORE