From Bloomberg:

-

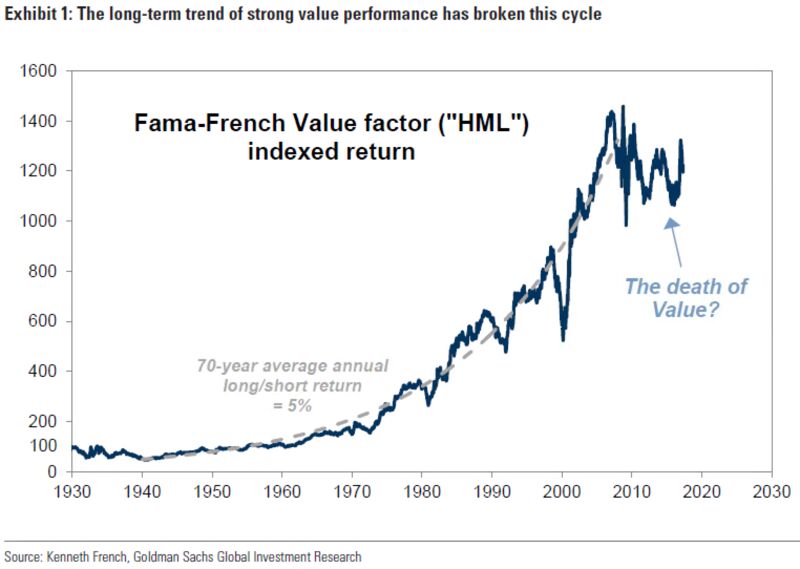

Strategy pioneeered by Fama-French underperformed average

-

Slow growth, aggressive monetary seen hurting value factor

There isn’t much value in value investing these days.

The value-factor strategy of buying stocks with the lowest valuations and selling those with the highest, pioneered by Eugene Fama and Kenneth French and espoused by none other than Warren Buffett, isn’t working. Sticking to that approach has resulted in a cumulative loss of 15 percent over the past decade, according to a Goldman Sachs Group Inc. report.

During roughly the same period, the S&P 500 Index has almost doubled. While followers of the value-factor strategy are enduring their longest sustained stretch of underperformance since the Great Depression, Goldman Sachs said it may be too early to give up on it.

“The fundamental backdrop for value returns has been especially unfriendly in recent years, but these conditions are unlikely to persist (and are already moderating),” a Goldman Sachs team led by equity strategist Ben Snider, wrote late yesterday in note to clients. “Nonetheless, the maturity of the current economic cycle suggests value returns will remain subdued in the near term.”

Most of the recent weakness can be attributed to the unusually slow growth and prolonged length of the current economic cycle, the strategists wrote. Specific characteristics of the equity market prior to the last crisis were also key, they said.

Waning cyclical headwinds are poised to fade, with the near-term outlook for growth stocks looking better, the report said. But so long “as humans continue to make investment decisions,” Snider wrote, value will work out over the long haul. However, the more widespread appreciation for and adoption of passive funds and smart beta strategies implies returns “will be harder to capture in the future.”

Value stocks tends to outperform when an expansion is broad-based and relatively robust -– generally at the start of an economic cycle, Goldman Sachs argues, and underperform when the economic backdrop is weak and growth scarce. The team said that the so-called new normal of slower growth magnified investors’ appetite for growth stocks like the FANG quartet....MUCH MORE